Product Validation 101: A Mix Method Approach

Ardavan HpProcess Overview

Executive Summary

"Product Validation 101: A Mix Method Approach" is a comprehensive framework crafted to assist businesses in effectively testing and validating new product concepts, particularly within the Fintech industry. This guide outlines a flexible, multi-faceted approach that combines both qualitative and quantitative research methods. Key components include community building, targeted surveys, sprint planning, prototyping, and iterative testing. The framework aims to ensure product viability, foster user engagement, and build trust within the target market, ultimately leading to a successful product launch.Introduction

As a seasoned UI/UX Designer, I developed the "Product Validation 101: A Mix Method Approach" framework to guide clients in testing and validating new product concepts in the Fintech sector. This framework provides a structured yet adaptable process, enabling companies to comprehensively evaluate their product ideas from multiple perspectives, ensuring both market fit and user satisfaction.Project Overview

Client Brief: Lytpay’s Seed Product Ideation TestingLytpay, a Fintech startup, introduced a novel concept known as "Seed" – a finance app designed to enable freelancers to collect and invest their income, accruing interest through a feature called "Fruits." Lytpay engaged my expertise to create an outline for testing their product ideas and hypotheses over the long term. The objective was to validate the product's viability and user appeal through a robust mix-method approach.

Product Concept: Seed

Seed positions Lytpay as a comprehensive income management app, reimagining the traditional pension model with short-term rewards. Mechanically, as freelancers' incomes grow, Lytpay allocates a seed fund that manages and invests the funds to generate interest, referred to as "Fruits." This system aims to provide daily-use financial benefits while promoting long-term financial growth and stability. ChallengeAt the ideation stage, Seed required a multifaceted testing approach encompassing social media community building, qualitative surveys, and quantitative research. The goal was to create not only a reliable test pool but also to build a community that fosters trust and word-of-mouth promotion. In the digital age, especially within finance and crypto sectors, establishing trust is crucial for app success.

Framework: Product Validation 101

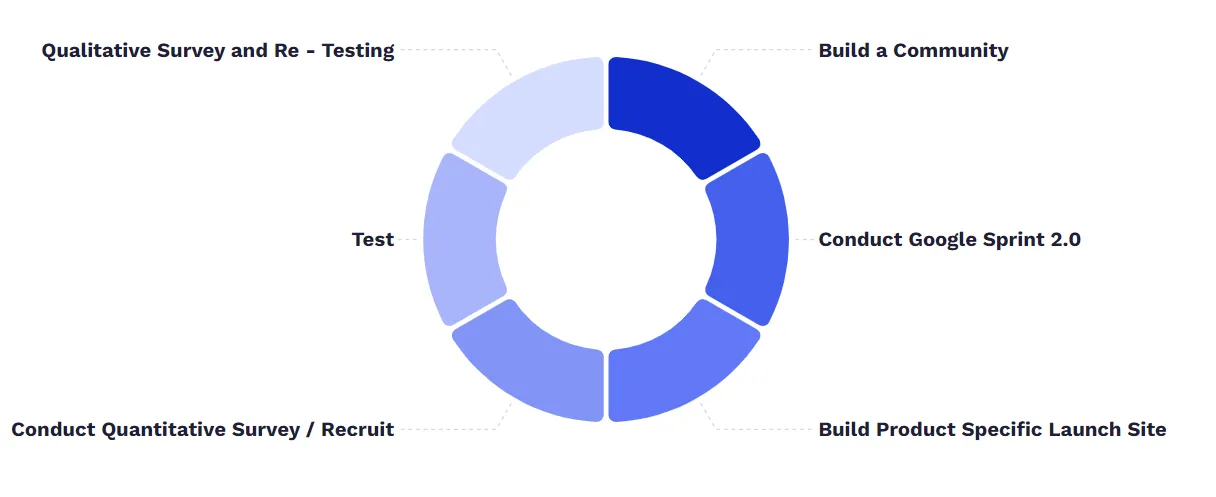

Building an Effective Full Circle ProcessOutcomes

Through the "Product Validation 101: A Mix Method Approach," the following outcomes were achieved:1. Build the Community

Purpose: The community breathes life into your product, creating credibility and fostering automatic customer acquisition.Benefits: An active community around a finance product builds trust and transforms the company from a silent app to a live, trusted entity.

Platforms: Facebook, Twitter, Discord, Reddit, Customer Service.

Strategy: Establish a strong online presence through social media platforms, leveraging tools like Twitter polls for quantitative research.

Note: Community building runs parallel to other steps, providing ongoing benefits in testing, marketing, and credibility.

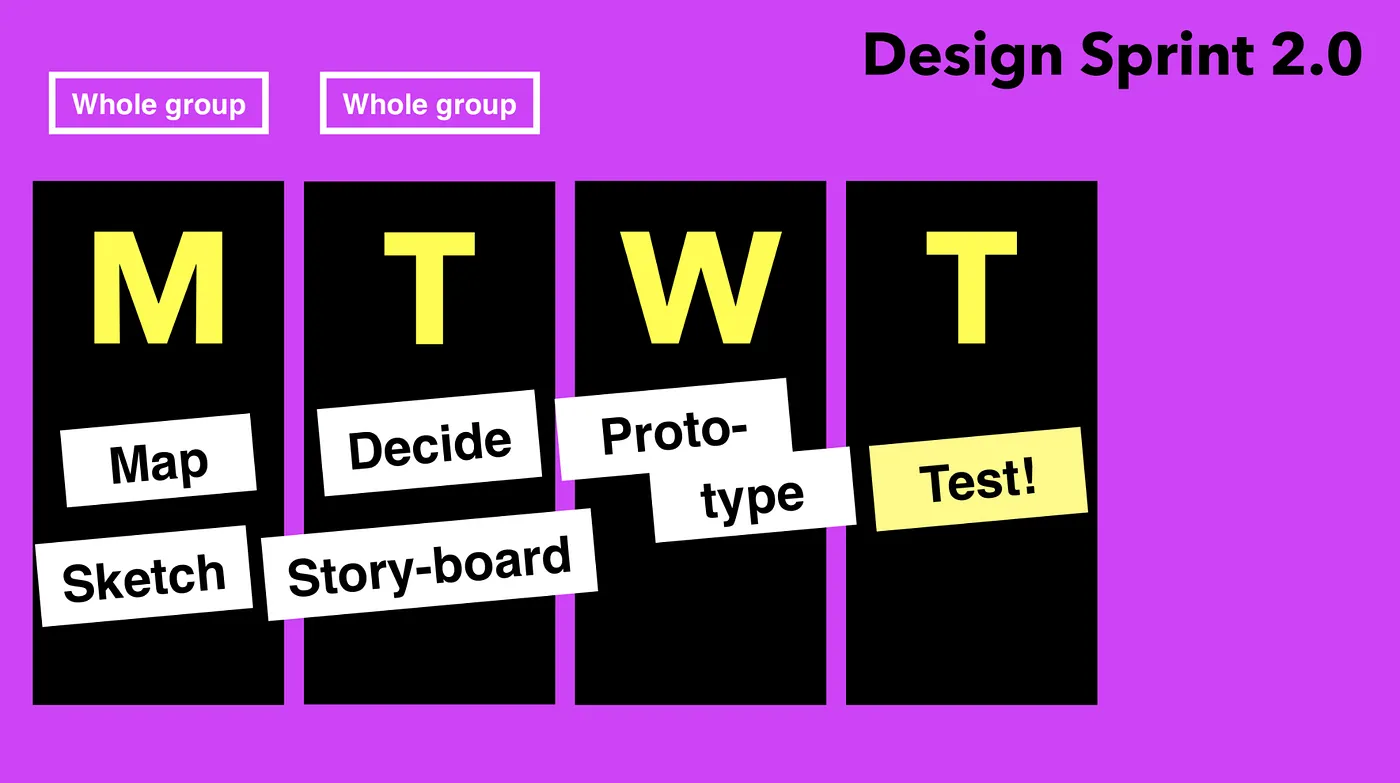

2. Conduct Sprints and Set Goals

Methodology: Implement Google Sprint meetings to clarify goals among team members and stakeholders.Importance: Focused sprints eliminate clutter, refine the work at hand, and ensure alignment on critical features.

Structure:

- Day 1 - Morning: Focus on a key component, gather input, identify issues, and map the customer journey.

- Day 1 - Afternoon: Sketch solutions, brainstorming without constraints.

- Day 2 - Morning: Showcase and vote on solutions, narrowing down to the most suitable.

- Day 2 - Afternoon: Develop detailed wireframes and storyboards.

- Day 3: Create a high-fidelity prototype in Figma for accurate user feedback.

3. Build a Landing Page

Objective: Clearly communicate the product’s purpose and value proposition.Components:

- Hero section with a compelling headline and visual representation.

- Feature highlights demonstrating how the app integrates into users' lives.

- Clear CTA buttons directing users to learn more, sign up for beta, or join a mailing list.

Tools: Google Analytics for monitoring user behavior, heatmaps for interaction insights.

4. The Survey

Goal: Filter potential users and understand their priorities, goals, and personas.Method: Use open-ended questions to gather in-depth insights and link surveys via platforms like MAZE or Usertesting.com.

Application: Utilize data from Twitter polls to validate ideas and engage the community.

Analysis: Highlight data trends to inform product development.

5. Test Time - Judgment Day

Procedure: Conduct user tests with interactive prototypes, ensuring they are concise and focused.Post-Test: Implement surveys to capture user feedback and areas for improvement.

Outcome: Gather actionable data to refine the product.

6. Qualitative Interview and Re-test

Process: Implement changes based on test feedback and re-engage users for further testing.Method: Conduct semi-structured interviews and in-person or Zoom tests.

Incentives: Provide rewards to encourage participation.

Feedback: Collect honest, in-depth user reactions to the updated product.